Sports betting offers the enticing possibility of earning a steady income, provided that one possesses the necessary knowledge and employs effective strategies. Despite this potential, the majority of bettors tend to experience financial losses over time. This trend can be attributed to various factors, including the utilization of specific tactics by bookmakers to maintain their edge in the industry.

In this article, we explain the methods bookmakers use to give themselves the advantage. We also look at the other main reason why they make money: most bettors make bad bets.

Bookmakers rake in profits through various methods:

1. Adjusting the vig to ensure favorable odds

2. Constantly updating betting lines

3. Managing risk by balancing the book

4. Capitalizing on bettors’ emotions and lack of expertise

The fundamental concept of bookmaking is quite simple and clear. Bookmakers accept money when customers place bets, and they payout when customers win. The key is to have more money coming in than going out. The skill of bookmaking lies in managing this balance.

Bookmakers may not influence the outcome of sports events, but they can influence their potential winnings or losses for each result. By setting the odds for all bets, they can ultimately secure a profit.

How does a Sports Bookie Make Money

Charging Vigorish/The Overround

Bookmakers employ a clever strategy called vigorish to tilt the odds in their favor. Vigorish, also known as juice, margin, or the overround, is a crucial component embedded within the odds set by bookmakers to ensure profitability. Essentially, it acts as a commission charged for accepting bets. To illustrate this concept, let’s delve into a simple example involving a coin toss.

When flipping a coin, there are two possible outcomes, each with an equal likelihood. The chances of landing on heads or tails are both 50%. If a bookmaker were to offer true odds for this coin toss, they would provide even money. In other words, the decimal odds would be 2.00, the moneyline odds would be +100, and the fractional odds would be 1/1. If you were to place a successful $10 bet at even money, you would receive a total of $20 in return, which includes your $10 profit along with the initial stake.

Now, let’s imagine that this bookmaker has 100 customers, each wagering $10 on the coin toss. Half of them bet on tails, while the other half bet on heads. In this scenario, the bookmaker would not make any profit at all.

In the image, the bookmakers are collecting $1,000 in bets and will have to pay out the same amount in winnings, regardless of the outcome. This is definitely not an ideal situation for them since they are in the business to make a profit.

To ensure they make money, bookmakers incorporate a vig into the odds. This way, they can guarantee a profit regardless of the result. When two outcomes are equally probable, they typically set the odds at 1.9091 (-110 in moneyline, 10/11 in fractional). For instance, in a coin toss scenario, the odds for heads and tails would both be 1.9091. If a $10 bet is successful, the total return would be $19.09 ($9.09 profit + $10 original stake). Now, let’s consider the bookmaker’s perspective with 50 customers betting on heads and 50 customers betting on tails.

Bookmakers always ensure they have an edge to guarantee profits, even if the odds change. This is evident in the fact that they pay out $954.50 against the $1,000 they receive in total wagers, resulting in a built-in profit margin of $45.50, or roughly 4.5%. While this example is simplified, it highlights how bookmakers use odds to their advantage. However, setting odds for sports events is more complex due to varying probabilities of outcomes. Bookmakers must employ additional strategies, such as odds compilers, to maintain consistent profits.

There are several factors that make earning money as a bookmaker more complex than just collecting vig. To ensure a steady stream of profits, additional strategies are necessary, and this is where the expertise of odds compilers becomes crucial.

The Role of Odds Compilers

Odds compilers play a crucial role in the world of bookmaking. They are essentially the architects behind the odds that determine how much action a bookmaker will attract and how profitable they will be. This process of setting the odds is commonly referred to as pricing the market.

Pricing up sports events involves a careful balance of statistical analysis and sports expertise. The main objective is to ensure that the odds accurately reflect the probability of each outcome, while also factoring in a profit margin. It’s a delicate art that requires a blend of numbers and intuition.

Compilers must possess extensive knowledge of the sports they are setting prices for, which is why they typically focus on specializing in one or two sports. Additionally, they need to have a strong grasp of mathematical and statistical concepts.

Analyzing the market for a tennis match featuring Novak Djokovic against Andy Murray requires the compiler to carefully assess various factors. This includes evaluating their current form, performance on the specific playing surface, and past head-to-head matchups.

Taking into account all of these elements, one could come to the conclusion that Djokovic has a solid 60% chance of emerging victorious in the match, while Murray’s chances stand at a respectable 40%. To mirror these probabilities, the odds would be approximately 1.67 for Djokovic and 2.50 for Murray. It’s important to note that these odds do not factor in any vig, which should also be taken into consideration.

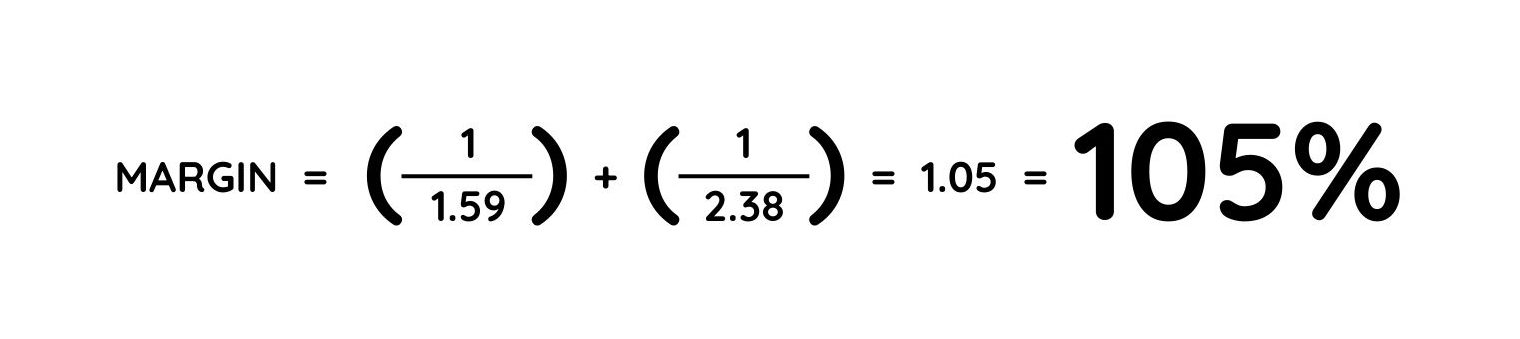

In most cases, compilers aim for a specific margin. The margin can fluctuate for various reasons, but for the sake of this example, let’s say the compiler is aiming for a 5% margin. This would result in reducing the odds for each player by 5%, resulting in 1.59 for Djokovic and 2.38 for Murray.

To determine a bookmaker’s margin, you can calculate it by summing up the reciprocals of the odds for each potential outcome and converting it into a percentage. In this scenario, we have two possible outcomes, and the equation below would be applied.

The compiler successfully hit the 5% margin target, but their work doesn’t stop there. They also need to ensure the bookmaker has a well-balanced book.

The compiler successfully hit the 5% margin target, but their work doesn’t stop there. They also need to ensure the bookmaker has a well-balanced book

Creating a Balanced Book

Having a well-balanced book in a specific market ensures that the bookmaker will make a consistent amount of money, regardless of the final outcome. On the other hand, an imbalanced book can lead to varying profits or even losses. It’s no wonder that a balanced book is the preferred choice for odds compilers.

Moving forward with the tennis match illustration mentioned earlier, a well-balanced book would appear as follows…

Based on $10,000 in total bets, the bookmaker is set to earn around $500 no matter what happens. This represents a 5% margin goal. Now, let’s explore the scenario where the $10,000 in total bets is evenly distributed between both players.

In this particular situation, the bookmaker finds himself with an unevenly balanced book. His potential profit lies in Djokovic’s victory, while a win by Murray would result in a loss for him. It’s a scenario that bookmakers typically strive to steer clear of.

That’s the reason why the odds on sports events are always changing. Odds compilers are constantly tweaking them to ensure their books are well-balanced. For instance, they might raise Djokovic’s odds to attract more bets on him winning, or lower Murray’s odds to deter additional bets on his victory. They might even do both simultaneously.

It’s not always a sure thing that tweaking the odds will automatically result in a well-balanced book, but it often does the trick. This is precisely why bookmakers place such importance on the volume of bets. As a general guideline, the more money flowing in, the higher the chances of achieving the right equilibrium. Perfectly balanced markets are actually quite rare; the ultimate aim is to come as close as humanly possible.

Keep in mind that odds compilers may intentionally create an unbalanced book at times. When they strongly believe in a certain result, they will adjust the odds to maximize their potential profit. For instance, if they are highly confident in Djokovic defeating Murray, they could increase the odds on Murray to attract more bets on that side of the book.

Bookmakers have a clear mathematical edge over their customers, which may not result in immediate wins on every market, but ultimately guarantees profits in the long term.

Price Per Head offers specialized services for Bookies aiming to establish a strong online presence. We grant access to cutting-edge user tracking and accounting software.